“The difference between what we do and what we are capable of doing would suffice to solve most of the problems of the World” Ghandi.

The economic recession is no doubt biting hard and many people have advanced possible solutions to get the economy back to normalcy. My training has taught me to solve a problem by first determining the root cause before attempting to proffer solutions and settle for the most cost effective and sustainable solution to the problem. In order therefore to arrive at the most cost effective method or solution to our present economic quagmire we should discuss the root cause.

I totally agree that the foundation of our present predicament was laid a long time ago. This is not to sweep under the suicidal wait for over six months for this present administration to hit the ground running. Desperate situation require desperate reaction. We shall get to this.

Nigerians must not forget that we had a diversified economy- relatively stable power, textile, steel and allied including aluminum and machine tool plants, relative agricultural base, tyre manufacturing, petroleum refining and petrochemical including the manufacturing of carbon black and plastics, car assembly plants, tractor assembly plants, cement manufacturing, fertilizer plants, paper manufacturing, river basins, breweries, marketing boards, service companies etc. These industries constitute the manufacturing and service base of the nation upon which the nation’s economy revolved especially the micro, small and medium scale enterprises (MSMEs) that rest upon them to survive. For example. the nail factories could easily source its raw materials from wire coils produced by the rolling mills for nail, office pin, paper clips manufacturing. The tyre-manufacturing industries like Michelin and Dunlop could partly source their major raw materials from the functional petrochemical plants, likewise the plastic industries. The MSMEs did not have to compete with the big companies and multinationals in the foreign exchange market for their critical spares, consumables and sometimes replacement of capital assets since they can do so through local fabrications. The overall effect then was less pressure on foreign exchange requirement as “a nation that imports all its requirements as it has been with us will always be faced with wants in foreign exchange and good things of life.”– Page 139 of the book “Who Says Government Has No Business in Business”

These base industries apart from providing the much needed goods for the nation minimized the demand for foreign exchange and therefore conserved it. They also served to give employment to our citizens, provide skilled and technical education through industrial attachments to students of tertiary institutions. Then federal government based on the advice by the international financial agencies opted to divest from their public enterprises as one of the conditions for economic assistance, and embraced privatization as an economic reform policy which ordinarily would guarantee better efficiency, probity and accountability in these enterprises. While this was at variance with the constitutional provision that the government should be at the commanding height of the economy, many still believed that the privatization would give a boost to achieving these benefits through generation of additional jobs for the country’s ever growing population from projected expansion of initial capacities of these assets by the new effective and efficient owners. This ordinarily very good initiative unfortunately, did not achieve the set-out results as evidenced by the failures of majority of the privatized companies many of which are still moribund or outright closed down. The result is the unimaginable high unemployment in the country arising from job losses, shrink growth and inflation rate.

The summary of this misadventure is as follows:

– Virtually every product that were hitherto produced locally albeit partially are now imported wholly into the country.

– There is a very high demand of foreign exchange by all and sundry for goods, services, equipment, machinery and spares. Those who cannot compete are forced to close down which explains the reason why many MSMEs with continuous support from government, still fail to survive the vagaries of the forex market.

– Very high unemployment rate among youths.

– Experience has shown that many of the graduates from our tertiary institutions now graduate without any industrial experiences. Students now seek irrelevant corporate entities including business centres for industrial training.

More importantly many of these assets (privatized companies) are locked-in without any form of production while some are alleged to being stripped by the new owners.

Put succinctly the nation’s development is stunted. To drive home the point, how can a country without a virile machine tool industry, steel and petrochemical plants develop any of its innovations from the universities, research centres into commercial scale. The only option is to develop these patents in other countries for us to import and royalties paid to their inventors.

This list of woes has informed this write-up to advise the federal government not to be prodded into any diversification mantra but should concentrate and embark on rebuilding the economy by extending full support to these privatized and moribund companies with a view to helping them restart these assets. I have always maintained that government never sold these assets for the purpose of making money but to re-position them for better performance and achieve the original objectives for which they were established.

The way to go!

Let me quickly mention that it is untrue the popular saying that government has no business in business. The constitution of the Federal Republic of Nigeria envisages this when it states in Chapter II 16 (1c) “without prejudice to its (State) right to operate or participate in areas of the economy, other than the major sectors of the economy, manage and operate the major sectors of the economy”. In other words the Federal Government is enabled by the constitution to do business with a view to realizing the objective in the same Chapter II Section 16 (1a ) ” harness the resources of the nation and promote national prosperity and an efficient, a dynamic and self-reliant economy”.

This provision is not peculiar to Nigeria alone as many governments have set up State-owned enterprises and empowered them in order to realize these objectives. Space will not allow me to elaborate on this but suffice to mention a few examples to buttress this position. The India Oil Corporation Limited is one of the Maharatna groups of companies owned by the state with the Indian government having 79 percent of the shares of the company. The corporation is the largest commercial enterprise in India, and owns companies that operates ten of India’s twenty refineries. IOCL incidentally is a major lifter of Nigerian crude which it imports, refines and re-export to other countries including Nigeria. It is rated as the 18th largest petroleum company in the world and the No. 1 petroleum trading company among the national oil companies in the Asia-Pacific region. By the way the Maharatna group of companies were set up by the Indian government and it comprises seven companies with a mission “that they would have comparative advantage by giving them greater autonomy and “muscle” to compete in the global market so as to support India in its drive to become a global economy”. Notable among them is the Coal India Limited which is the largest coal producer company in the world contributing around 81 percent of the coal production in India. The Government of India owned 89.65 percent of the shares. “It is also important to note that the Korea Electric Power Corporation (KEPCO) also mentioned in earlier chapter is one of the core investors in the privatized 1320MW Egbin Power Station ,the company has the Korean government as its majority shareholder. The Korean government directly owns 21.17 percent, and the Korea Finance Corporation (KoFC) a wholly owned government financial corporation owns 29.94 percent bringing the government shareholding to 51.11%. Other shareholders are National Pension Corporation 6.21 percent, Treasury Stock 2.95 percent, Public (Non Koreans) 27.7 percent and Public (Koreans)12.03 percent.” Page 113 Who Says Government Has No Business in Business” Similar scenarios abound in China and it is an irony that the Nigerian government is signing contracts and doing business with state-owned enterprises while deluding itself that its government has no business in business. I must also state that even in the United States and the western world the various governments engaged in one form of business or the other including bail-outs to private enterprises, taking quasi-equity for various strategic and national reasons.

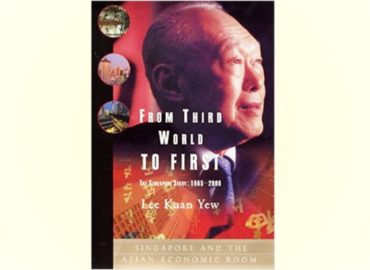

Many examples abound on the roles of governments as strategic business partners in the development of their nations’ economies such as South Africa, Ethiopia, Malaysia, Singapore and even Saudi Arabia. Lee Kuan Yew the first Prime Minister of Singapore in his book “From Third World to First” wrote “The government took the lead by starting new industries such as steel mills( National Iron and Steel Mills) and service industries such as shipping line Neptune Orient Lines( NOL) an airline, Singapore Airlines (SIA). ……. The projects succeeded. When these (projects) also were successful, we turned state monopolies such as the PUB( Public Utilities Board, the Port of Singapore Authority and Singapore Telecom into separate entities, free from ministerial control, to be run as companies, efficient profitable and competitive. The key to success was the quality of the people in charge”.

I will conclude this justification by quoting from PricewaterCooper (PwC) April 2015 paper “State-owned Enterprises -Catalyst for Public Value Creation? that “SOEs are likely to remain an important instrument in any government’s toolbox for societal and public value creation given the right context,……”. It concluded in the report that SOEs have not only gone global but have now become a global force. Why we have literally succumbed to corruption and greed to learn from infallible precedents to grow and develop our economy is unexplainable?

Having argued this far, I posit that the Federal Government should re-evaluate the status of the privatized companies with a view to helping them to restart and operate them. Most of the manufacturing plants privatized still have a lot of operating life left in them and it is cheaper, easier, faster to reactivate these companies instead of waiting for other private entrepreneurs to build new ones under this harsh economic conditions.

The Bureau of Public Enterprises (BPE) should be restructured and duly staffed to champion this role. The funds used for unending bail-outs, grants and doles to Nigerians under various poverty alleviation program should be invested in these companies in form of quasi-equity and re-inflate these companies. The status of each of these privatized companies should be evaluated to identify the type of assistance required. Government through the restructured BPE must ensure that bankable business plans, targets, timelines, standard operating procedures with adequate monitoring are put in place before government can take quasi-equity. We can start with very strategic industries to our ailing economy. These things are doable if we set our minds to achieve them. It is certainly unjustifiable that an important asset that was privatized in 2006 has never operated and everybody including the government who privatized it is unperturbed by this development. Meanwhile the products from such company are being imported and we are crying for inadequate forex. There is need for rethink.

What has happened to over 16000MW of power generation licenses issued by Nigerian Electric Regulatory Commission since the Power Sector Reform of 2005? Less than 10 percent of this figure has been realized and added to the nation’s installed capacity.

What can be done to change this scenario considering the importance of power to operate our industries?

Anthony Madagua wrote in from Abuja